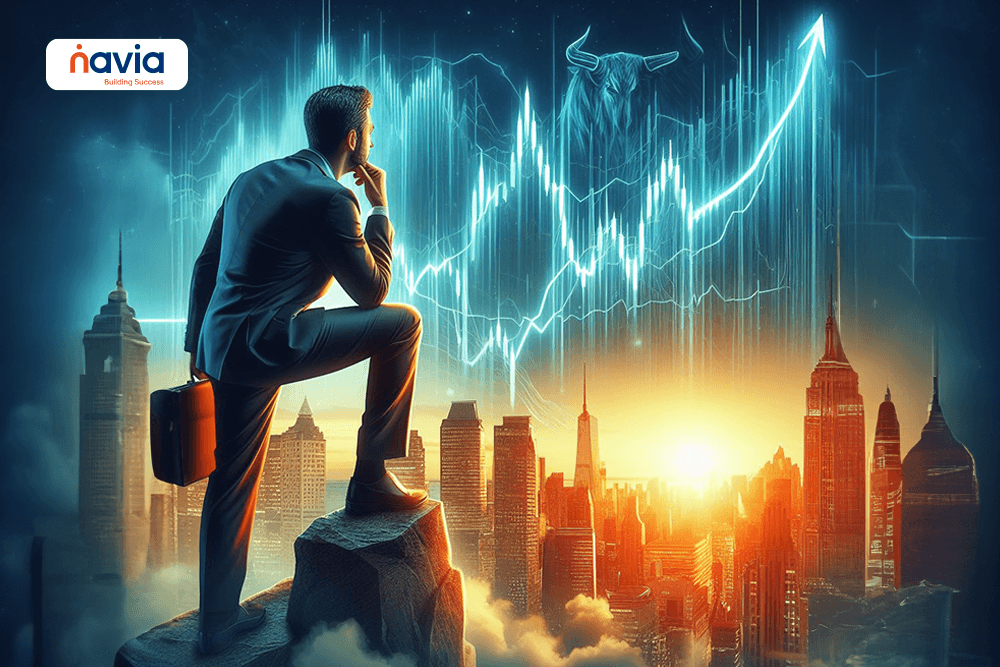

Unlocking Opportunities: NSE’s Exciting Venture into Nifty Next 50 Index Derivatives

Introduction Get ready for an investment revolution as the National Stock Exchange of India (NSE) gears up to launch derivatives based on its popular Nifty Next 50 index, starting April 24, 2024. This move, backed by regulatory approval from the Securities and Exchange Board of India (SEBI), promises to transform the way traders and investors […]